If you deposit 100000 in your savings account for 12 months the bank will in return pay a rental fee interest rate usually between 05-2 to you for borrowing your money. Foreign-sourced interest income is specifically tax exempt.

Chapter 5 Non Business Income Students

For example lets say you want to apply for a 6-Month FD with a minimum deposit of RM5000 at 365 per annum pa.

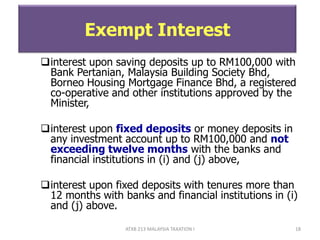

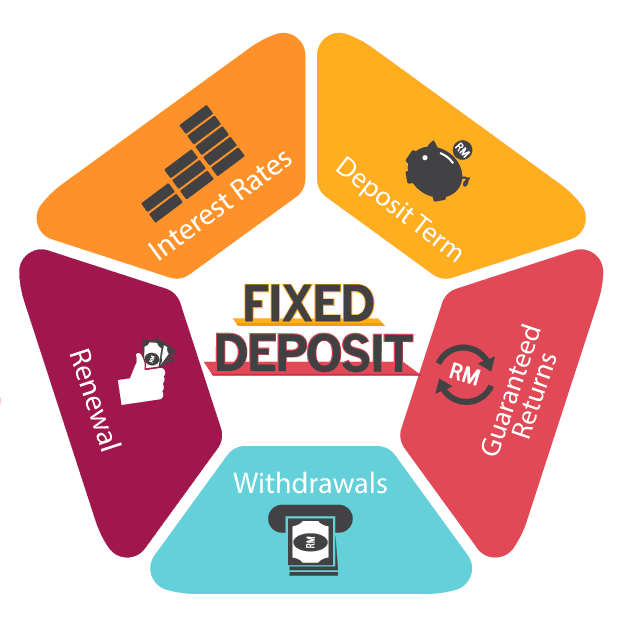

. The Securities Commission Malaysia requires at least 90 of the net asset value NAV of a retail money market fund to be invested in short-term bank deposits of less than six months fixed deposits FDs of more than six months commercial paper and short-term corporate bonds with maturities of not more than a year. The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable. Are Fixed Deposits valid for Tax Exemption.

Youll then have earned between RM 500 RM 2000 in 12 months. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia and one leave passage outside Malaysia not exceeding RM3000. Individuals must note that Term Deposits are taxed at the rate of their gross income which implies that if they are a part of the 10 tax bracket they will have to pay a tax of 10 on their income that they receive from their Term Deposit interest.

There are no premature withdrawals loans. In case of interest from fixed deposits for Non-Resident OrdinaryNRO Tax Deduction at Source TDS is charged at the rate of 30. The fixed deposit will need to follow the below.

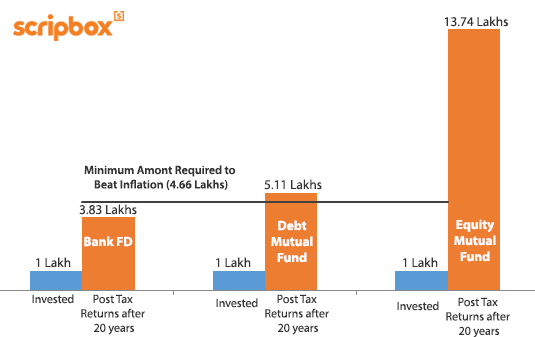

An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits. As part of a Tax Saving Fixed Deposit interest earned is taxable which is deducted at source. As per the government and the announcement made by the Finance Ministry in 2006 an investment made in a tax saving fixed deposit which has a minimum of 5 years lock-in period is valid and eligible for a tax deduction as per section 80C of the Income Tax Act of 1961.

Things like parking and childcare allowances which fall under Perquisites above can also be exempted from tax. Medical benefits as well as childcare benefits provided by the employer. An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits.

The exemption of Paragraph 2 of Schedule 4 is available to individual only and is allowed as follows. 1 Leave Passage Vacation time paid for by your employer in two categories. What about TDS or Tax Deducted at.

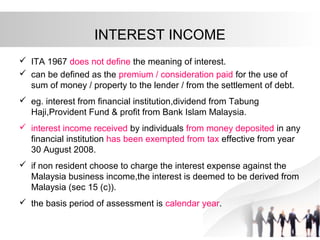

If your interest income from all those FDs goes beyond Rs. However if you do not provide your PAN details to the bank it will deduct 20 TDS from interest income on FDs. The determination of the source of interest income is significant as only interest derived from Malaysia is taxable in Malaysia.

The following are exempt in the hands of the employee. Record of TDS payments that are deducted on Fixed Deposits are included in Form 26AS. Disposal of the whole share owned by individual The exemption is RM10000 or 10 of the chargeable gain whicever is greater.

Or - RM10000 for every completed year of service with the same employer companies in the same group. RM300000 Interest restricted ----- x RM40000 RM400000 RM30000. This tax exemption applies for individuals who are Malaysian citizens and its divided into four main categories.

The amount of interest expense deductible against the gross income from its business has to be restricted. RM10000 of income from royalties of artistic works excluding paintings recording discs or tapes. The following income categories are exempt from income tax.

40000 then there will be a TDS deduction at a 10 rate. So why would your bank pay you a rental fee. The interest restriction is computed using the formula in paragraph 62 of this Ruling as follows.

EXEMPTION RPGTA has several provisions for exemption and among the provisions are. Income Exempt from Tax Income Exempt from Tax Compensation for loss of employment and payments for restrictive covenants - full exemption if due to ill health. In case of interest from fixed deposits for senior citizens tax exemption is Rs 50000 per annum under section 80TTB.

Additionally where interest is paid to a non-resident the interest derived or deemed derived from Malaysia is subject to withholding provisions. The bank will make a TDS deduction on the interest from all the fixed deposits you have with the bank. Leave passages restricted to one overseas trip up to a maximum amount of MYR 3000 and three local trips including meals and accommodation per year.

For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax.

Types Of Bank Deposits And Accounts In India

What Are The Reduced Tds Rates For Fy 2020 21 Ay 2021 22 With A Threshold Limit Quora

Personal Income Tax Interest Income Tax Treatment

In The Matter Of Interest Crowe Malaysia Plt

Deutsche Bank Fd Rates Fixed Deposit Interest Rate Calculator 2022

Pros And Cons Of Public Provident Fund Ppf Account For Tax Saving On India

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

Benefit Of Fixed Deposits Need Cash Go For Overdraft Against Fixed Deposit The Financial Express

Fixed Deposits 5 Benefits Beyond Interest Rates That Make Fds Good Investment Option

Taxation Principles Dividend Interest Rental Royalty And Other So

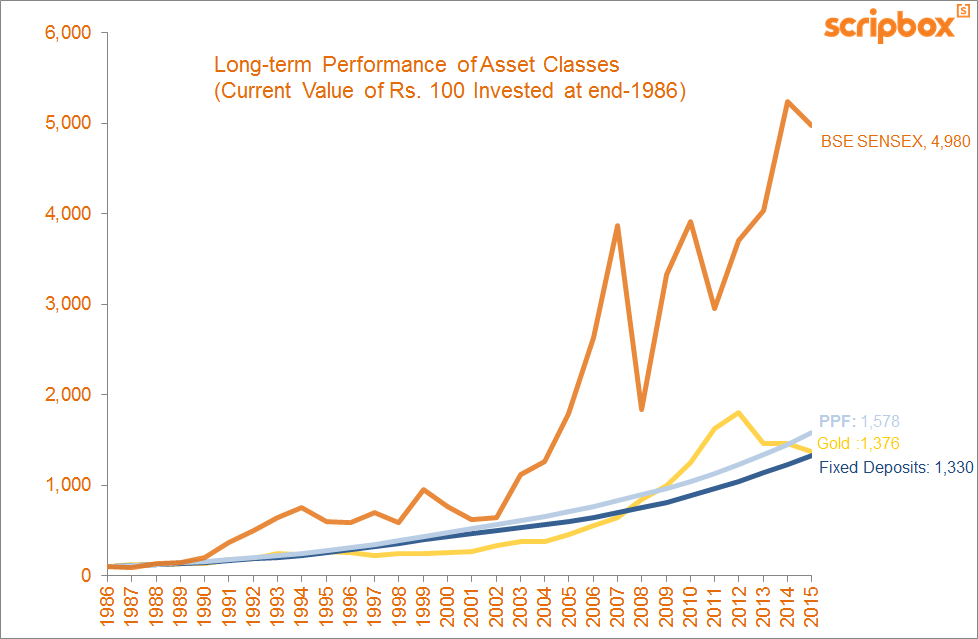

2 Reasons Why Fixed Deposit Wont Make You Rich Scripbox

Not Disclosed Interest On Fd Bank Savings Be Ready For Income Tax Dept Notice Businesstoday

Taxation Principles Dividend Interest Rental Royalty And Other So

How To Gain From Higher Tax Deduction Limits Businesstoday Issue Date Dec 01 2014

2 Reasons Why Fixed Deposit Wont Make You Rich Scripbox

How To Gain From Higher Tax Deduction Limits Businesstoday Issue Date Dec 01 2014

Fixed Deposit Rate Of Interest In India Best Fixed Deposit Options